Tax season is upon us and cyber criminals are using this opportunity to set traps for taxpayers. A common scam is phishing emails that purport to be official communications from tax filing companies or legitimate messages from the Canada Revenue Agency (CRA). They often contain deceptive language that entices the recipient(s) to follow specific instructions.

Common types of scams

The CRA has identified some known types of tax-related scams, including but not limited to:

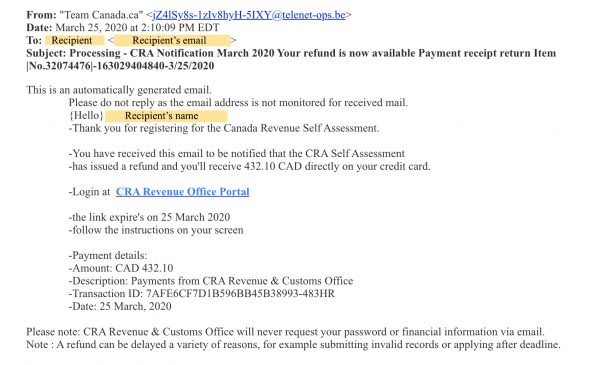

- Messages that encourage you to click on a link to claim a refund.

- Messages that notify you of an unpaid balance and threaten you with jail time if you don’t pay.

- Messages that instruct you to follow a link to review changes in your account or to fill out a form with your login credentials and personal information.

Tax refund phishing email received by members of the University of Toronto (U of T) community:

Resources on what the CRA does and does not do when they contact you. The CRA also provides examples of fraudulent emails.

What to do if you suspect a phish

If you received a suspicious email relating to the CRA or tax filing:

- Report it using the “report message” function in your inbox if you are using U of T Office 365/UTMail+. Otherwise, please report it to report.phishing@utoronto.ca.

- Do not follow any instructions in the email, delete it.

- Report the email to the Canadian Anti-Fraud Centre.

Here’re some tips to help you find the “report message” function in Outlook:

-

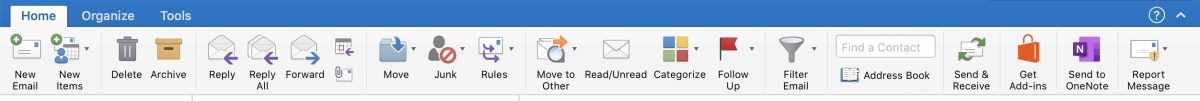

In the Outlook desktop app, the “report message” button is in the upper right corner of the menu bar:

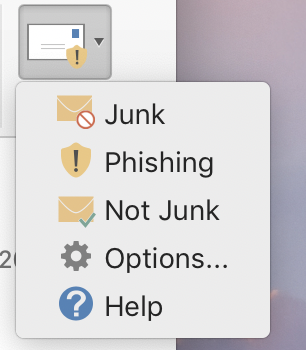

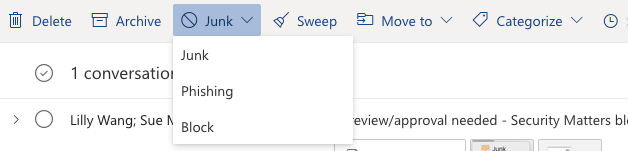

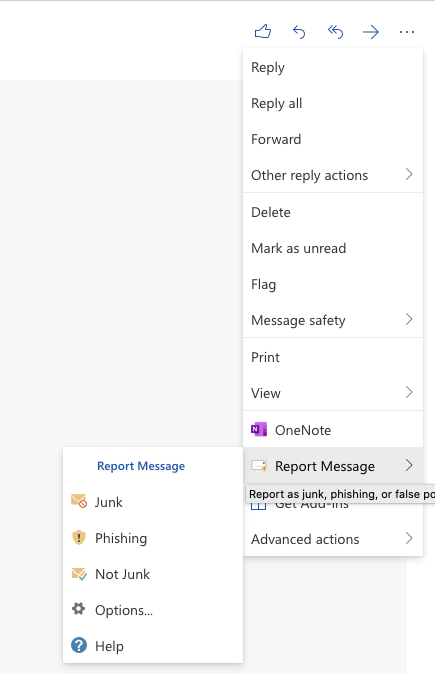

- In the Outlook webmail, you can access the report function from two places:

-

From the preview pane:

-

From the email message:

Tax filers should be vigilant about tax-related communications either by phone, mail, text message or email. Never give out personal information, including financial information or login credentials to unidentified personnel.

When in doubt, always login to your CRA account through a trusted browser or call CRA’s Individual Income Tax Enquiries line at 1.800.959.8281.

For more tax-related scams and best practices to protect yourself, visit the CRA security site.